How to Take Advantage of New Federal Heat Pump Rebates

Here at Service Champions, we love sharing exciting news. So, for those considering a more energy-efficient heating and cooling system, this post contains excellent news.

As of January, two new federal tax credits and rebate savings incentives mean transitioning to a greener heat pump system is even more accessible and affordable to all.

So why the changes?

Global warming is a growing issue, so the government is encouraging homeowners to move towards energy-efficient heat pump cooling and heating systems. So, if you want to upgrade your heating and cooling system and reduce your carbon footprint, now is the ideal time.

You could save up to $8000 on your new system. But which system should you choose, and will it suit your home? That’s where we come in. We’ve gathered all the information you need about heat pumps to help you determine which systems qualify for the tax credit or rebate savings.

The Inflation Reduction Act

The whole Inflation Reduction Act is long and complicated. But here’s a quick summary to help you understand the main points.

The Background

It may have taken over a year of planning and negotiations, but the Federal Government finally passed the Inflation Reduction Act (IRA) in August 2022.

The main goal of the Act is to help combat the issue of climate change. We all know that our planet is struggling, and it’s up to us to take action to ensure a better future for our children and grandchildren. If we don’t take action soon, who knows what natural disasters may happen in the future?

What the Act Means for You

Let’s get into the nitty-gritty of it all. If you’re a homeowner enthusiastic about switching to eco-friendlier energy alternatives like heat pumps and electric vehicles, there’s good news for your bank balance.

On top of that, if you come from a lower-income household, you could also benefit from the IRA’s heat pump rebate. This rebate covers anywhere from 50% of the total installation costs of your heat pump.

What is a Heat Pump?

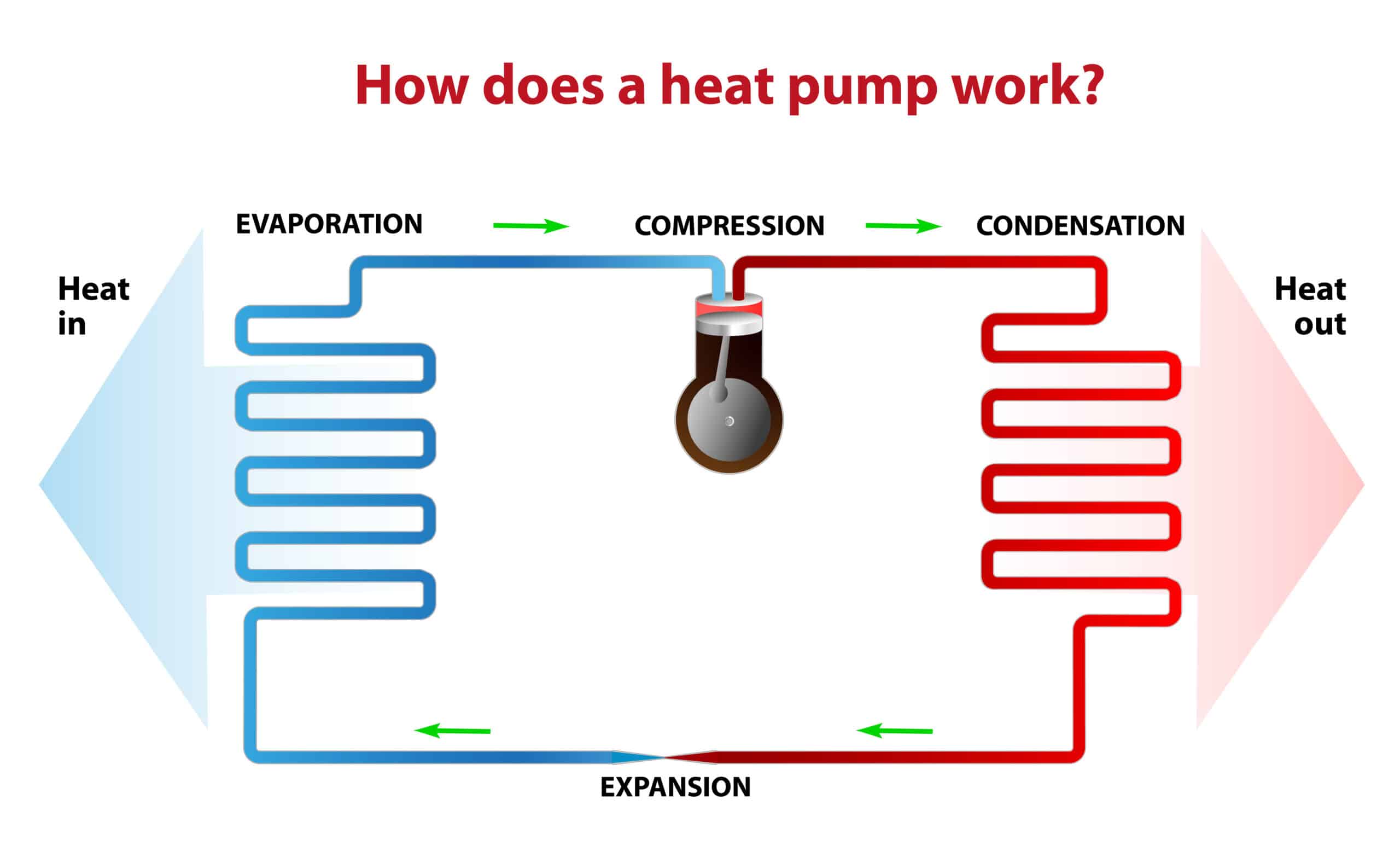

A heat pump is an air-to-air heat exchanger that transfers warmth from one location to another. A refrigeration cycle moves heat from one place to another to both heat and cool your home.

Heat pumps don’t generate heat. They transfer it. A refrigerant absorbs heat from the outside air (or ground). As it warms up, it evaporates and travels along the system to a compressor, increasing its temperature. Eventually, the gas reaches the coil inside your home, where the air is cooler. It condenses, releasing the trapped heat into your home before returning to the outdoor coil so the cycle can start over again.

The best thing about heat pumps is that they don’t need fuel. So you save on your energy bills.

The best thing about heat pumps is that they don’t need fuel. So you save on your energy bills.

Benefits of a Federal Energy-Efficient Heat Pump

There are several benefits to having a heat pump installed, including:

Lower Utility Bills

If you want to save money on your monthly bills, there’s no better way than with an energy-efficient heat pump. These systems optimize usage while ensuring you have a comfortable home, saving you money in the process.

State Requirements

Some states require upgrades to more energy-efficient appliances as part of an initiative to reach zero-carbon emissions nationwide. If you live in one of these states, you may be required to adopt greener energy solutions.

Eco-Friendly

Along with saving money on energy bills, energy-efficient appliances like heat pumps burn less fuel, without sacrificing the warmth of your home, and limit the consumption of precious natural resources.

Which Systems Qualify?

Switching to a heat pump might sound like the ideal way to reduce your energy bills. But there are a few points to consider before you head out to make a purchase. Not all heat pumps qualify for tax credit or rebate savings. If unsure, but the general guidelines are as follows.

Energy Star Systems

To be sure you’re getting a professionally approved heat pump (or any other appliance), look for the Energy Star Efficiency Certificate. These products undergo intensive tests and must meet the energy efficiency criteria set out by the US Environmental Protection Agency or the US Department of Energy.

Different Systems Covered

Heat pumps aren’t suitable for all homes. However, that doesn’t rule you out of the savings. There are other options apart from the rebates on heat pump purchases. Appliances include replacement installation of HVAC, furnaces, or boilers. But ensure they meet the energy-efficiency standards.

CEE Tier 1 & 2 Requirements

The Consortium of Energy Efficiency (CEE) set out guidelines that heat pumps must meet to qualify for the savings. For example, a split-system ducted heat pump must be in Tier 1, whereas a non-ducted heat pump falls in Tier 2.

What Federal Tax Credits Are Available?

Tax 25C

Tax 25C

This tax credit is a nonbusiness property energy credit. It allows you to claim up to 30% capped tax credit for installing energy-efficient products like heat pumps, water heaters, and electric panels or for carrying out energy audits.

This credit isn’t lifetime. You can access new credits each year for eligible upgrades, as long as you have adequate tax liability, as long as you qualify for Tax 25C.

Tax Credit Amounts

There are various amounts allocated to different products and appliances. However, the principal amounts are as follows:

- Heat Pumps – up to $2,000

- Air Conditioners – up to $600

- Furnaces – up to $600

HEEHRA Act Energy Efficiency Rebates

Good news if you’re from a lower-income family interested in saving money while doing your part for the environment. With the new rebate program, you can switch to a more energy-efficient heating system without breaking the bank.

If your household income is 80% less than the average income in your area, the program offers a rebate for a new heat pump purchase valued up to an incredible $8,000. What’s more, households with income levels between 80% and 150% of the median average income can still qualify for a rebate of up to 50%.

If your household income is 80% less than the average income in your area, the program offers a rebate for a new heat pump purchase valued up to an incredible $8,000. What’s more, households with income levels between 80% and 150% of the median average income can still qualify for a rebate of up to 50%.

You can also get rebates for other energy-saving products:

- Electric stove/cooker top $640

- Electric wiring $2,500

- Weatherization $1,600

- Heat Pump Water Heater $1,700

It’s a fantastic opportunity to switch to greener energy while saving money on energy bills.

Save More with Local Energy Rebates

It isn’t only the Federal Government offering money back for sustainable energy sources. Individual States have their own set of financial incentives to encourage citizens to move toward greener living.

The regulations and qualifications differ from State to State, so check out your region to see if you’re eligible.

And if you plan on upgrading any appliances soon, it’s worth looking at Energy Star Certified products. Again, a range of rebates and discounts are available from $30 upwards. The Energy Star Rebate Finder is a handy tool to help you figure out the best appliance for your money.

Combining State and Federal Rebates

Yes, you could combine both Federal rebates and State payments. However, the rules around this are still a little murky. The law is relatively new, and it will be down to individual states to decide how they interpret the regulations.

At present, as long as your State rebate isn’t funded by Federal money, it should be good to go.

At present, as long as your State rebate isn’t funded by Federal money, it should be good to go.

How to Apply for Tax Credits and Rebates

Knowing the difference between the HEEHRA rebates and the tax credits is essential to determine which one you qualify for before purchasing.

The rebate system is the way forward for low to moderate income households. A rebate is a discount given at the time of purchase. As mentioned above, low-income families could be eligible for a total $8000 rebate.

How do you get the rebate? It’s a straightforward process. You find a registered contractor (they must be a participating contractor, you can’t carry out the work yourself), and they handle the paperwork for you. Once the replacement installation is complete, you get a bill minus the rebate.

On the other hand, those who earn a higher income can apply for a tax credit as part of their yearly tax return. This leads to a larger tax refund or a lower tax bill.

Need clarification on the tax credit application process? Seeking guidance from a tax advisor is highly recommended. That’ll help ensure you accurately fill in your tax form to receive the full amount of credit you’re entitled to claim. With an expert’s help, you can easily navigate the application process, maximizing your savings.

Want to find out more about Federal Energy Efficient heat pumps? Contact the HVAC experts at Service Champions for professional advice.

Tax 25C

Tax 25C